How to delete PayPal account ? [2023]

Last updated on October 2nd, 2023 in General

Say goodbye to your PayPal account! Whether you’ve found a better alternative or simply want to cut ties with the digital payment giant, to delete PayPal account is easier than you think.

In this step-by-step guide, we’ll walk you through the process of waving farewell to PayPal and explore some compelling reasons why you might want to do so.

But don’t worry – we won’t leave you high and dry without some handy tips for managing online transactions without a PayPal account.

So grab your virtual shredder and let’s get ready to delete PayPal account once and for all!

PayPal has become a popular payment method for online transactions, but there may come a time when you decide that it’s no longer the right fit for you.

PayPal has become a popular payment method for online transactions, but there may come a time when you decide that it’s no longer the right fit for you.

Whether you’ve found an alternative platform or simply want to close your account, deleting your PayPal account is a straightforward process. Here is a step-by-step guide to help you through it.

1. First, log in to your PayPal account using your credentials. Once logged in, navigate to the “Settings” section of your account. Look for the “Account” tab and click on it.

2. Within the Account menu, find and select the option labeled “Close your account.” This will take you to a page with information about closing your PayPal account.

3. Before proceeding further, take some time to review any pending transactions or outstanding balances associated with your PayPal account. Make sure everything is resolved before moving forward.

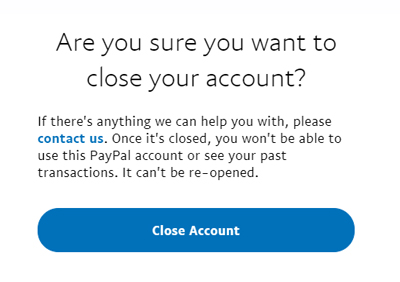

4. Next, click on the link that says “Close Account” at the bottom of the page. You may be prompted to confirm this decision by entering additional details or verifying certain security measures.

Once confirmed, PayPal will initiate the closure process and send an email notification confirming that your request was successful. It’s important to note that this action cannot be undone, so double-check all details before submitting.

Deleting your PayPal account can vary slightly depending on factors such as country-specific regulations or business accounts versus personal accounts. If you encounter any difficulties during this process or have specific concerns related to closing your PayPal account, it’s recommended contacting their customer support team directly for assistance.

Remember that once deleted, your PayPal account cannot be recovered and any recurring payments or subscriptions linked to it will also be canceled.

There can be various reasons why someone might choose to delete PayPal account. Let’s explore some of the common factors that lead individuals to take this step.

1. Privacy Concerns: One of the primary reasons people opt to close their PayPal accounts is due to concerns about privacy and security. With increasing instances of data breaches and online scams, users may feel more comfortable using alternative payment methods that offer stronger protection for their personal information.

2. Dissatisfaction with Service: Some individuals may have had unsatisfactory experiences with PayPal, such as poor customer service or difficulty resolving issues related to payments or transactions. This frustration could lead them to seek out other platforms that better meet their needs.

3. Limited Usage: If you no longer find yourself using PayPal frequently or if it doesn’t align with your current financial habits, deleting your account can help declutter your online presence and simplify your digital wallet management.

4. Changing Payment Preferences: As technology evolves, new payment options emerge in the market. You might decide to explore different payment systems that offer additional features or benefits tailored specifically to your requirements.

5. Business Closure: For entrepreneurs who have closed down their businesses, there may no longer be a need for a PayPal account dedicated solely to business transactions. In such cases, closing the account can provide closure and tie up loose ends.

Remember, these are just a few examples of why someone might choose to delete PayPal account – everyone’s circumstances are unique! It’s important to evaluate what matters most in terms of convenience, security, and overall satisfaction when deciding whether or not it’s time for you personally move on from using this platform.

After you delete PayPal account, there are a few things you should be aware of. All your personal information and transaction history will be permanently removed from the platform. This includes any linked bank accounts or credit cards that were associated with your account.

Additionally, any recurring payments or subscriptions that you had set up through PayPal will no longer be processed. It’s important to make sure you have alternative payment methods in place for these services to avoid any disruptions.

Furthermore, if you had any pending transactions at the time of deletion, they may still go through depending on the timing. However, since your account will no longer exist, refunds or disputes related to these transactions may become more complicated.

It’s also worth noting that once you delete PayPal account, it cannot be undone. If you change your mind later on and wish to use PayPal again, you’ll need to create a new account from scratch.

It’s essential to carefully consider the implications before deleting your PayPal account and ensure that you have alternative payment options available for online transactions.

While PayPal is a popular and widely used payment platform, there are several alternatives available that can suit your needs. Here are some options to consider:

1. Stripe: This online payment processor offers seamless integration with websites and apps, making it easy for businesses to accept payments from customers worldwide.

2. Square: Known for its user-friendly interface and simple pricing structure, Square provides tools for accepting payments in person or online. It also offers additional features like inventory management and customer tracking.

3. Venmo: Owned by PayPal itself, Venmo is a mobile payment app specifically designed for peer-to-peer transactions among friends and family members.

4. Apple Pay: If you’re an iPhone user, Apple Pay allows you to make secure purchases in stores, apps, and on the web using your device’s built-in NFC technology.

5. Google Wallet: Similar to Apple Pay, Google Wallet enables Android users to send money securely through their smartphones or via Gmail attachments.

6. Amazon Payments: With millions of customers already linked to their accounts on Amazon.com, this option makes it convenient for shoppers as they can use the same login credentials across various platforms.

Remember to research each alternative carefully before making a decision based on your specific requirements.

Tips for Managing Online Transactions without a PayPal Account

Tips for Managing Online Transactions without a PayPal Account

1. Explore alternative payment platforms: While PayPal may be popular, there are other reliable and secure payment platforms available. Research and consider options like Stripe, Square, or Google Pay that offer similar functionality.

2. Use credit card payments: Many online merchants accept credit card payments directly. You can securely enter your card details on the merchant’s website without the need for an intermediary like PayPal.

3. Set up direct bank transfers: Some websites allow you to make purchases by linking your bank account directly to their platform. This eliminates the need for a third-party payment processor altogether.

4. Consider digital wallets: Digital wallet services like Apple Pay or Samsung Pay provide easy and convenient ways to make online transactions without relying on PayPal.

5. Utilize cryptocurrency: Cryptocurrencies such as Bitcoin have gained popularity as alternative means of conducting online transactions securely and anonymously, like for example paying for VPNs.

6. Look out for seller-specific payment methods: Certain sellers might offer specific payment methods, such as Venmo or Zelle, which don’t require a PayPal account.

7. Keep track of receipts and invoices: Without PayPal’s transaction history feature, it becomes essential to keep detailed records of all your online purchases and sales.

8. Be cautious with personal information sharing: When making payments outside of established platforms like PayPal, exercise caution while providing personal information to ensure privacy and security.

9. Stay informed about scams and frauds: It is crucial to stay updated on common online scams in order to protect yourself when managing transactions independently from PayPal.

10. Seek customer support from individual merchants if needed: In case you encounter any issues during an online transaction without using PayPal, reach out directly to the merchant’s customer support for assistance.

Remember that while deleting your PayPal account may come with its own set of challenges, managing online transactions independently can still be done effectively by exploring various alternatives available in today’s digital landscape!

Deleting a PayPal account may seem like a daunting task, but with the step-by-step guide provided in this article, you can easily close your account if that is what you desire. Whether it’s for security concerns, a shift in payment preferences, or simply wanting to explore alternative options, deleting your PayPal account gives you the freedom to take control of your online transactions.

Remember to consider the reasons behind your decision and make sure it aligns with your needs and goals. Explore alternative payment platforms such as Stripe, Venmo, or Square if you still require online payment services without using PayPal.

Managing online transactions without a PayPal account may require some adjustments initially. However, by following tips like keeping track of receipts and utilizing secure payment gateways offered by e-commerce platforms and other digital wallets, you can ensure smooth and secure financial transactions.

In conclusion (without stating “In conclusion”), deleting a PayPal account is not an irreversible decision. If at any point in the future you decide to return or re-activate your account, PayPal provides an option for reopening accounts within 90 days of closure. So remember that there are options available should circumstances change.

The choice of whether or not to delete PayPal account rests entirely on personal preference and circumstances. By understanding how to navigate through the process outlined here and exploring alternatives available in today’s digital landscape, you can confidently make informed decisions about managing your online finances while protecting yourself from potential risks associated with having a PayPal account.